UK Salary Calculator 2025-2026

Calculate your Net Pay and take-home salary for your 2025/26 budget. See a full breakdown of Income Tax, National Insurance, Student Loan, and more.

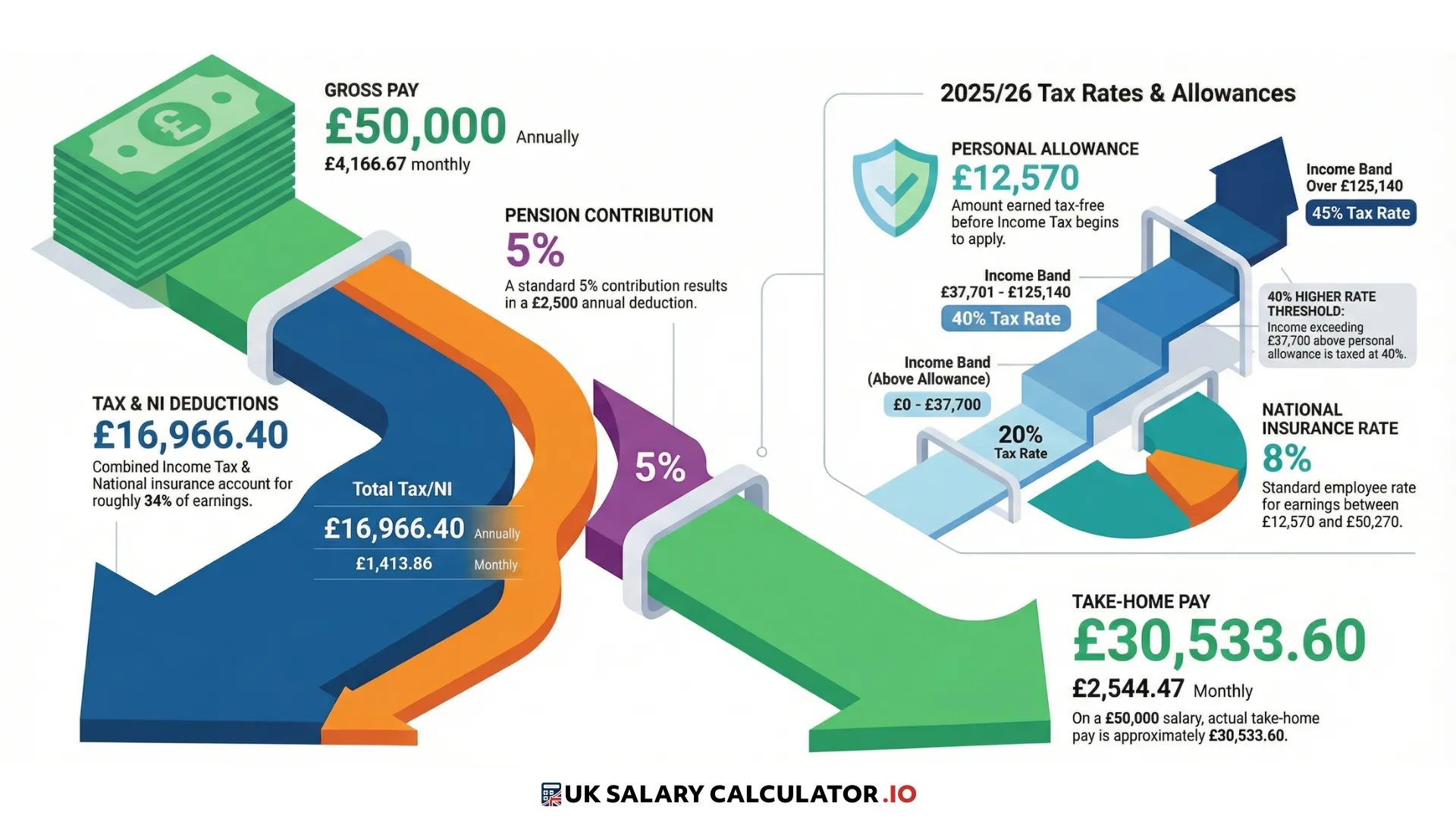

Your Results

A breakdown of your income and deductions.

Take-Home Pay

£30,533.60

- Take-Home£30,533.60

- Tax£13,972.00

- NI£2,994.40

- Pension£2,500.00

| Gross Pay | £50,000.00 |

| Income Tax | -£13,972.00 |

| National Insurance | -£2,994.40 |

| Pension Contribution | -£2,500.00 |

Tax Band Breakdown

Visualize how your income is taxed across different bands.

Salary Simulators

See "What If" scenarios without changing your main data.

Pension Power-Up

Increase your contribution to see how it affects take-home.

Bonus Impact

See how a bonus affects your take-home.

Adding this to a single month's pay.

Marriage Allowance Check

Can you save £252?

Since one earns < £12,570 and the other pays Basic Rate, you can transfer allowance.

Key Deductions Explained

Tax Bands & Allowances 25/26

A summary of the income tax rates and allowances.

Allowances

| Personal Allowance | £12,570 |

| Income Limit for Personal Allowance | £100,000 |

| Blind Person's Allowance | £3,070 |

| Married Couple's Allowance | Up to £1,127 tax reduction |

Tax Bands (above personal allowance)

| Income Band | Tax Rate |

|---|---|

| £0 - £37,700 | 20% |

| £37,701 - £125,140 | 40% |

| Over £125,140 | 45% |

Figures are for the 2025/2026 tax year. For a full breakdown, read our tax bands guide.

Student Loan Thresholds 25/26

Repayment starts on income above the threshold.

| Income | Repayment Rate |

|---|---|

| Below £24,990 | 0% |

| Above £24,990 | 9% |

For a detailed breakdown of plans, see our student loan guide.

National Insurance 25/26

Employee (Class 1) NI contributions.

| Earnings | Rate |

|---|---|

Below £242/week Below £12,570 | 0% |

£242 - £967/week £12,570 - £50,270 | 8% |

Above £967/week Above £50,270 | 2% |

For more details, use our National Insurance calculator.

2026 Tax Landscape: What You Need to Know

Prepare for the upcoming changes affecting your take-home pay, savings, and business income.

The "Fiscal Drag" Alert

Frozen thresholds until 2031 mean "standard" pay rises are pushing earners into higher tax bands, including the 40% rate and the notorious 60% tax trap.

Pro-Tip

Check your projected tax band after any pay rise. The hidden cost of fiscal drag often catches PAYE earners off guard.

2026 Dividend & Savings Crunch

Detail the April 2026 Dividend tax hike (10.75% / 35.75%).

The "Savings Allowance" trap

Once you hit the Higher Rate (£50,270), your tax-free interest allowance drops from £1,000 to £500.

Pro-Tip

Consider shielding interest in an ISA to avoid the allowance reduction if you're nearing the Higher Rate threshold.

The "Director's Dilemma"

With Employer NI rising to 15% and the threshold dropping to £5,000, the traditional "low salary, high dividend" model is losing its edge.

Salary vs. Dividends for 2026/27

Taking a higher salary (up to the Personal Allowance or beyond) may now be more tax-efficient than relying solely on dividends, saving Corporation Tax in the process.

Pro-Tip

Run the numbers again. The new £5,000 employer NI threshold drastically changes the optimal split.

Explore Our Suite of Financial Calculators

Take-Home Pay

HMRC Tax Calculator

Self Assessment

Pension Calculator

Child Benefit

Childcare Costs

Cost of Living

National Insurance

VAT Calculator

Bonus Tax

Corporation Tax

Certificates of Tax Deposit

Capital Gains Tax

Inheritance Tax

Stamp Duty (SDLT)

Capital Allowances

Alcohol Duty

Import Duty

Gambling Tax

HMRC Compliance Checks

Contractor (IR35)

Umbrella Company

Mortgage Repayments

Hourly to Salary

Overtime Pay

Minimum Wage

Shift Work Pay

Frequently Asked Questions

Why Use Our UK Salary & Tax Calculator?

We provide more than just a simple take-home pay figure. Our platform offers a complete suite of financial tools designed to help you understand every aspect of your earnings for the 2025/2026 tax year.

- ✓Accurate Tax Breakdowns: Precise calculations for Income Tax, NI, and Student Loans.

- ✓Smart Planning Tools: Optimise pension contributions and bonus payments.

- ✓Visual Insights: Dynamic charts to see exactly where your money goes.

- ✓For Everyone: Tailored support for employees, contractors, and higher earners.

Explore the powerful simulators below, built directly into our platform to help you plan smarter.

Visual Deduction Pie Chart

See exactly where every penny goes with our dynamic chart.

Marginal Tax Band Visualiser

Check how close you are to the next tax bracket—don't get caught out!

Pension Power-Up Slider

Slide to see how increasing contributions boosts your take-home efficiency.

Bonus Split Simulator

Compare paying a bonus in one month vs splitting it over two.

Marriage Allowance Check

Instantly see if you're eligible to save £252/year.

Contractor & Freelancer Insights 2026

Real-world comparisons for IT contractors, consultants, and locums. Understand the true cost of IR35.

£500/day Inside vs Outside IR352025/26 Est.

Inside IR35 (Umbrella)

£5,800 - £6,200

Monthly Net Pay (Approx)

Subject to PAYE & NICs

Outside IR35 (Ltd Co)

£7,200 - £7,800

Monthly Net Pay (Approx)

Dividends & Salary Mix

£650/day Umbrella vs Limited2025/26 Est.

Umbrella Company

£7,200 - £7,600

Monthly Net Pay (Approx)

Full Employee Taxation

Limited Company

£9,100 - £9,600

Monthly Net Pay (Approx)

Tax Efficient Planning

How much do umbrella companies take?

Umbrella companies typically charge a margin for their services. This is usually deducted from your gross pay weekly (£15 - £35) or monthly (£80 - £130).

- Fixed Fee vs Percentage: Reputable umbrellas charge a fixed fee. Avoid those charging a % of your invoice.

- Hidden Costs: Watch out for signup fees, exit fees, or charges for same-day payments.

Is Inside IR35 worth it?

While "Outside IR35" is financially superior, many contractors find "Inside" roles offer stability and higher day rates to compensate for the tax hit.

When to accept Inside IR35:

- The day rate is uplifted by 20-25% to cover NICs.

- You want zero administrative durability (no company filings).

- It's a "stop-gap" contract while waiting for an Outside role.

*Estimates based on typical 2025/26 tax rates. Individual circumstances regarding expenses, pension contributions, and tax codes will vary.